Kathleen Sullivan

Assistant Vice President

NMLS 467369

Office: (540) 834-5767

Cell: (540) 847-5084

kmsullivan@mtb.com

2101 Plank Road

Fredericksburg, VA

Kathleen Sullivan

Assistant Vice President

NMLS 467369

Office: (540) 834-5767

Cell: (540) 847-5084

kmsullivan@mtb.com

2101 Plank Road

Fredericksburg, VA

It's nice to meet you.

Kathleen Sullivan has invested more than 30 years in the banking/mortgage industry helping customers achieve their dream of home ownership.

Whether you're buying, selling, refinancing or building your dream home, working with a seasoned professional can make everything simpler and easier. As an experienced loan officer, I have the knowledge and expertise to help you explore the many financing options available and ultimately make the right choice for you and your family.

I'm committed to providing my customers with an experience that will exceed their expectations, and I look forward to working with you.

Areas of Expertise

- First Time Homebuyer Programs

- New Construction

- 1 Close Construction

- Jumbo Mortgages

- Mortgage Refinances

- Investment Properties

Awards and Achievements

- 2016-2017 Presidents Club Winner

- 2020-2022 Presidents Club Winner

Understanding what to expect is important.

I understand applying for a home loan can be a little stressful. That's why M&T Bank has made our home loan process simple, easy and efficient. Plus, I'm here to go over your options and guide you through the entire process.

- Pick Your Loan Preference.

M&T Bank offers a variety of mortgages to meet your needs. I'll help you weigh all your options and choose the right option for your goals. - Apply Online.

It takes just minutes and you can do it from any device. I'm here to help you every step of the way. - Gather Your Paperwork.

Upload electronic copies or photos of all your documents like W-2s and paystubs. As your mortgage expert, I can help you get the ball rolling. - Shop for Your New Home with Confidence.

With a pre-approval from M&T Bank, you have more than a verbal thumbs-up. You'll now have your financing in place that can help you fast-track the home-buying process. - Secure Your Place with an Appraisal.

Congratulations, you've found a home you love! I'll order an appraisal to ensure there are no issues and get you ready to close. - Sign, Close and Call the Movers.

It's that simple.

M&T Bank offers an array of refinancing options that can help you put the power of your home to work by choosing new mortgage terms, interest rates and monthly payment options. Here are five important factors I'll help you consider when deciding if the time is right to finance:

- Monthly Payments.

Lower your total monthly payout with the right M&T Bank refinance could help reduce, consolidate or even eliminate all your monthly bills. - Cash Flow.

Put your home equity to use for a home refresh, paying off credit cards or even funding a college savings plan. Once we know your goals, I can use my mortgage expertise to help you achieve them. - Terms.

As we collaborate, I'll always ask you to look at the bigger picture. Don't be surprised when topics like retirement plans or other milestones come up. Knowing your plan helps me tailor the ideal mortgage term. - Tax Benefits.

Could you optimize your savings through tax deductions like mortgage interest, property taxes and mortgage insurance? We'll explore these areas, as well. (Always remember to consult your tax adviser) - Payment Deferment.

Typically, there is a gap between when your existing mortgage is paid off and when your new mortgage payments begin, affording you a little break. We'll talk about how to spend it wisely.

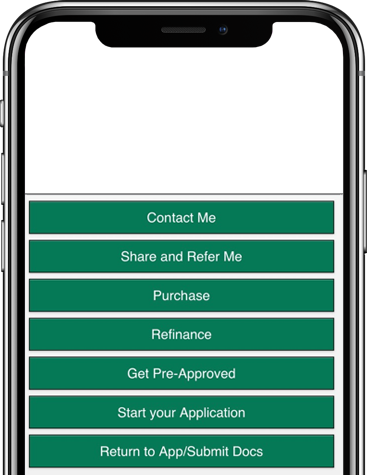

Help is at your fingertips.

Access and bookmark my mobile app for helpful tools, a convenient link to your online mortgage application as well as my contact information and more. You can learn about M&T's different mortgage options and even apply online and receive updates throughout the process. It's your direct line to getting the answers you need, anytime.

All fields required.

Get home faster with M&T Mortgages

MORTGAGES MADE EASY

At M&T Bank we understand all the decisions you need to consider when buying a home. Choosing the right loan shouldn’t be a difficult one. See how our process helps you get home faster.