Your Guide

To Buying a House

Buying a home is an exciting milestone in life. Our goal is to help you understand the ins and outs of the homebuying process.

As you read through this guide, remember that you’ll have support from our dedicated team of experts to help you along the way.

1. Save What You Can

There’s a common myth that you need to have substantial money saved in order to buy a home. In most cases, you will need to have some funds available to put towards a down payment, closing costs, an appraisal, home inspection, and other fees associated with obtaining a mortgage. The good news is there are a variety of mortgage programs available to help you cover these costs.

Managing Mortgage Costs

When working with your lender, ask them about options to roll closing costs into your mortgage. They can help you explore different mortgage programs and also guide you towards non-profit organizations and government agencies for grants and down payment assistance.

It’s a good idea to reserve some funds to have on hand after you close on your home. These funds can be used towards moving expenses, home improvements, or to cover unplanned expenses.

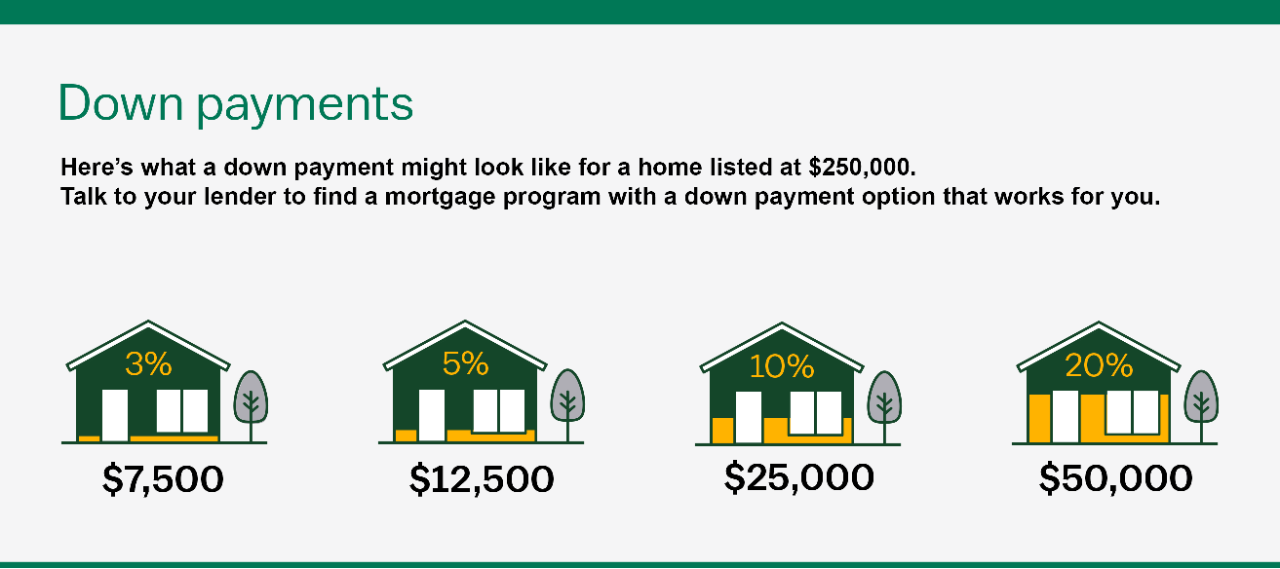

Down Payment Myth

There’s a popular myth that you need to put down 20% to buy a home. While putting down 20% allows you to avoid paying private mortgage insurance (PMI), you can still buy a home with a smaller down payment.

First-Time Homebuyer Tip

Closing costs can sometimes be rolled into your mortgage. Talk to your lender to see if this is an option and ask about programs available to help cover your closing costs and down payment.

2. Get Your Financial House in Order

Before you start the homebuying process, it’s important you review your finances and understand your credit score as it will have a direct impact on your mortgage interest rate. It’s also a good idea to start creating a budget with your future home in mind.

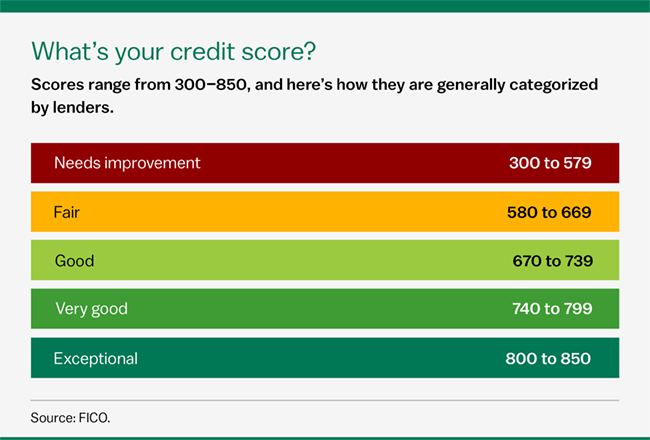

Your Credit Score

Having a high credit score and low debt-to-income ratio can positively impact your mortgage interest rate and eligibility. If your credit is less than perfect, talk to your lender to see what mortgage options are available.

What is a credit score?

A credit score is a number calculated from several aspects of a person’s financial picture and history. It’s used by lenders to help determine a person’s credit worthiness and their ability to make monthly mortgage payments. To calculate your score, credit bureaus look at your payment history, debt obligations, available credit, credit history, recent inquiries and more. There are three credit bureaus - Equifax, Experian, and TransUnion which lenders rely on for credit reporting purposes.

What is a debt-to-income ratio?

A debt-to-income ratio is calculated by dividing your monthly debt obligations by your gross monthly income. Lenders consider your debt-to-income ratio to help them determine how much home you can afford on a monthly basis. It’s recommended that you review your short- and long-term debts, such as car payments, student loans, and credit cards as they will all be considered when applying for a mortgage.

First-Time Homebuyer Tip

Before you apply for a mortgage, review your credit reports for accuracy. If you find any incorrect information, you will want to dispute those items with the credit bureau(s) and have it corrected. It’s important to get your credit in the best shape possible.

3. Research the Market

Purchasing a home is a major financial decision that requires time and research to find the right one. At this point, you can work with a real estate agent, who will help you navigate this step in the homebuying process.

Do Your Homework

Real estate markets fluctuate, and so do home values by neighborhood. If home prices are too high in your desired neighborhood, then you may need to consider exploring options nearby. Expanding your search can allow you to find the amenities you’re looking for at a price you can afford.

Here is what you should consider when buying a home:

One of the most important factors is choosing the right location for you. Local market conditions will vary, and your research will help you gain valuable insights. Looking at home values and considering property taxes is a good idea.

You will want to find a home that meets your needs and lifestyle. Often, this includes a preferred school district, proximity to work, cultural interests, hobbies and entertainment.

Before you start looking for a home, you'll need to determine what you can afford. Consider how much you have saved to put towards a down payment and other cost associated with a mortgage. It’s also a good idea to figure out what kind of monthly mortgage payment you can comfortably afford.

Your home should be thought of as an investment. When home values increase and your mortgage value decreases, you’re building wealth.

First-Time Homebuyer Tip

Before you start your home search, make a list of your "must-haves" vs "nice to haves". This will help you narrow down your search and find the right home. A few of the most popular “must-haves” include a spacious yard, pool, recently remodeled kitchen, and quiet neighborhood.

4. Get Pre-Approved

A mortgage pre-approval strengthens your homebuying power and shows sellers that you’re a serious buyer. Once you’re pre-approved, you’ll have a pre-approval letter in hand to share with your real estate agent or the seller when making an offer on a home.

Not One Size Fits All

The mortgage process is not one size fits all. Talk to a

loan officer, so they can understand your unique situation and provide you with mortgage options.

Our pre-approval process is quick and easy.

There are many benefits to having a pre-approval:

Allows you to shop for a home with confidence.

Shows sellers you’re working with a reputable lender.

Details about how much home you can afford.

Creates for a smoother homebuying process.

First-Time Homebuyer Tip

If you're not pre-approved yet, click here to get started today.

5. Building Your Homebuying Team

During the homebuying process, you’ll want to form your “homebuying team.” Your team should include trusted professionals who can help guide you along the way. Your homebuying team may include a loan officer, a real estate agent, an attorney or title company, a home inspector and other experts as needed.

Who Is On Your Team

- Loan Officer will help you find the mortgage that's right for you and be your go-to for all things mortgage related.

- Real Estate Agent will help you find a home, make an offer, and shepherd you through the entire process.

- Attorney or Title Company will assist with the legal paperwork needed during the home buying process.

- Home Inspector will complete an inspection of the home you're looking to purchase and identify any issues or concerns that the buyer should be aware of before purchasing the home.

First-Time Homebuyer Tip

First-time homebuyers may need additional guidance building their team and navigating through the home buying process. In some cases, they may be required to attend home ownership education sessions providing them the knowledge and support they need.

6. Find the Right Home

Sometimes finding the right home can take time, and everyone's homebuying journey is different. Once you find your new home, it's time to put in an offer.

Start Your Application

Once your offer is accepted, reach out to your loan officer as soon as possible to start your mortgage application.

First-Time Homebuyer Tip

With an M&T Personal Banking relationship, you may be eligible for a mortgage rate discount. Talk to your loan officer today to learn more.

7. Submit Your Mortgage Application

Once your offer is accepted and you’re under contract, it's time to start your mortgage application. Your loan officer will review your sales contract and determine if the terms of your pre-approval still remain the same. During this time, your loan officer will review your mortgage terms and interest rate again.

Your mortgage term

This is the number of years that will appear on your mortgage note to pay back the loan. The most common terms are a 30-year or 15-year mortgage. Typically, a shorter mortgage term may carry a lower interest rate.

Your interest rate

Your interest rate is the percentage you pay to borrow funds for a specific period of time.

An annual percentage rate (APR) includes your interest rate, as well as additional fees and expenses associated with taking out your loan.

The difference between interest rate and APR is that your interest rate represents the cost you’ll pay each year to borrow funds. APR is a measure of the cost to borrow funds that considers additional fees. Since APR includes your interest rate and other fees, your APR will be a higher number than your interest rate.

Next Steps

Once your mortgage application is submitted, your loan

officer will let you know when it’s time to schedule a home inspection. After the inspection, your lender will order an appraisal to determine the fair market value of the property.

When your mortgage application package is complete, it will

go to underwriting for a loan decision. If you’re approved, you’ll receive a final approval letter.

First-Time Homebuyer Tip

After underwriting review, they may need additional information or documentation to decision your loan. It’s critical to get these items back to your lender as soon as possible to stay on track and meet your closing date.

8. Close on Your Home

Once you receive your final approval, it’s time to close on your mortgage. Three days prior to your closing, you’ll receive your Closing Disclosure. Please review this document carefully, as it outlines the final terms of your mortgage and details whether you need to bring funds to your closing. If you have any questions, now’s the time to talk to your loan officer.

Congratulations On Your New Home!

Your lender's closing agent will reach out to you to schedule

a closing date and time. Closings are generally done in-person and involve the signing of mortgage documentation to transfer ownership of the property and finalize your mortgage.

After your mortgage closing, it’s time to get the keys

to your new home.

First-Time Homebuyer Tip

M&T Bank offers a number of convenient ways to make your monthly mortgage payments. Visit How to Pay Your M&T Mortgage and learn more about the different ways to pay and our flexible payment plan.