Understanding Bank Transactions

Learn how and when banks post credits, debits and fees to proactively avoid overdrawing your account.

Bank transaction posting is a key aspect of managing your checking, savings or money market account.

The order of when banks post transactions can affect your account balance and whether or not you are charged with fees such as an overdraft fee.

Types of Bank Transactions

A bank transaction is any money that moves in or out of your bank account. Types of bank transactions include cash withdrawals or deposits, checks, online payments, debit card charges, wire transfers and loan payments.

What is transaction posting order?

Transaction posting order is the process of applying transactions—both debits and credits—to your account balance. Posting order is important if there is not enough money in your account to pay all of the transactions you initiate. The order can affect the number of transactions that overdraw your account or that are returned unpaid, as well as the number of fees you may have to pay. Transactions can be posted to your account in "batch" (a number of transactions posted at the same time at the end of the business day) or in "real time” (transactions posted as they are made).

Most transactions post at the end of each business day but posting order and times can vary. Business days for banks are generally Monday - Friday from 9am to 5pm, excluding federal holidays. Transactions received outside of these hours, including on weekends, are usually posted on the next business day.

Batch Transactions

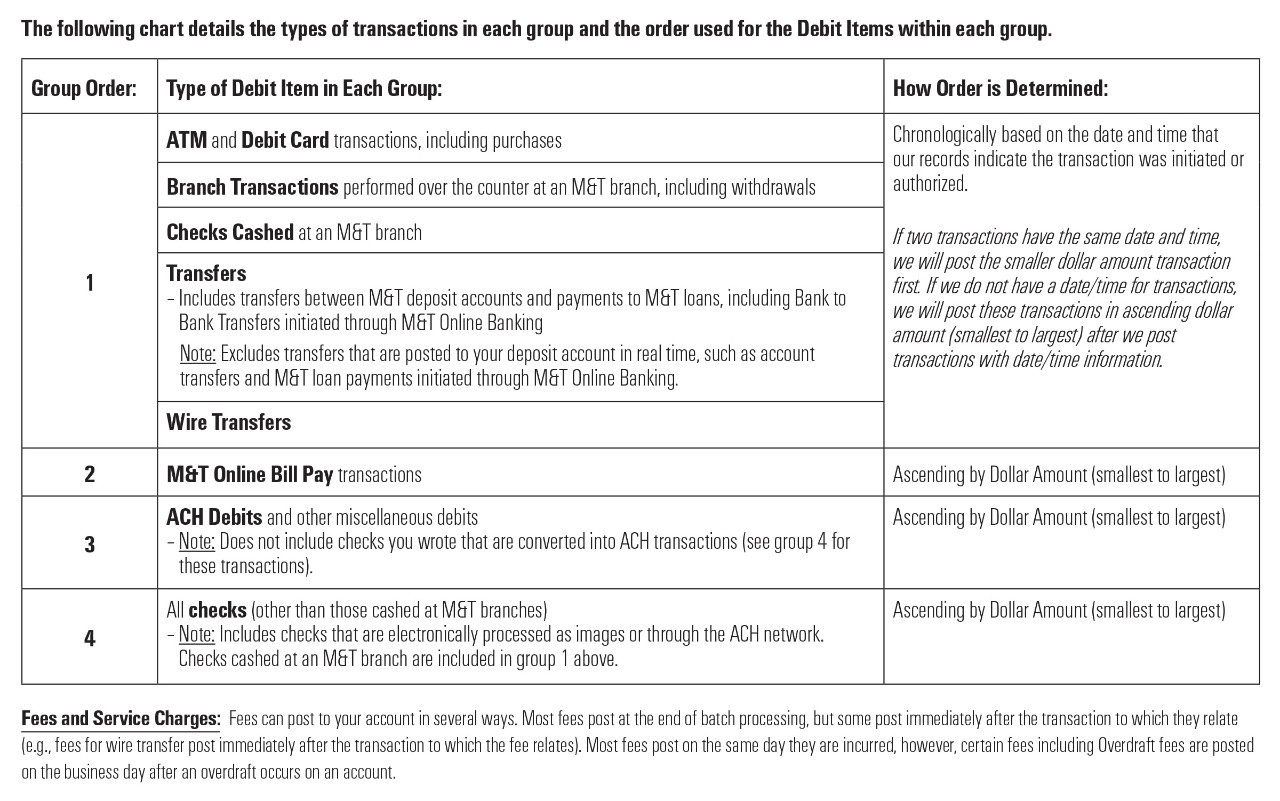

Batch transactions are processed in groups, or “batches” at the end of each business day. Batch transactions are posted in the following order:

- Credits are posted to your account first. Credits includes deposits, as well as reversals and adjustments for transactions from prior business days that have not already posted in real time. Interest credit; however, is credited at the end of the batch.

- Debits posted to your account second. Debits include cash withdrawals, checks you write, online payments and debit card transactions. Debit card transactions are posted chronologically or when our records indicate the transaction was made, but checks (other than those cashed at an M&T branch) will post by dollar amount in an ascending order (that is, lowest dollar amount items first) within the group noted for that type of Debit Item.

- Fees are posted to your account last. Most fees post on the same day they are incurred. Certain fees, including overdraft fees, are posted on the business day after an overdraft occurs on an account. Fees are posted in order from lowest to highest dollar amount.

Real Time Transactions

Real time transactions are processed instantly as they are made. At M&T Bank, these include:

- Transfers between accounts at M&T and payments to M&T loans made through M&T Online Banking or through one of our Contact Center Representatives

- Certain reversal transactions of a prior credit or debit posted to your account

Posting Order for Consumer Time Deposit Accounts

After posting credits to your account and reversals and adjustments for transactions from prior days, we process and record debit items received for payment from your account on a given business day. These are posted from lowest to highest dollar amount. We post fees and charges on the business day they are incurred after we post the days debit items. Fees are posted in low to high dollar order.

Get Started Today

FAQs

What are business days for banks?

Business days for banks are typically Monday through Friday from 9 a.m. to 5 p.m., excluding federal holidays. Transactions received outside of these hours are typically posted on the next business day.

Do banks process debits or credits first?

At M&T Bank, credits are posted to your account first, debits are posted to your account second and fees are posted to your account last.

What is a batch transaction?

Batch transactions are processed in groups, or “batches” at the end of each business day. Batch transactions post credits first, followed by debits, then fees.

What is a real time transaction?

Real time transactions are processed rapidly. Real time transactions include transfers between accounts at M&T, payments to M&T loans and certain reversal transactions of a prior credit or debit posted to your account.

Do banks process payments on weekends?

Weekends are generally non-business days for banks. Payments received on weekends are generally processed on the next business day, Monday, unless it’s a federal holiday.

A Bank You Can Count On

We know you count on your personal checking and savings accounts to meet your everyday banking needs. With M&T, you can count on so much more. Discover how we go beyond the basics to meet all your banking needs in the branch and online, now and in the future.

Disclosure:

- Unless otherwise specified, all advertised offers and terms and conditions of accounts and services are subject to change at any time without notice. After an account is opened or service begins, it is subject to its features, conditions and terms, which are subject to change at any time in accordance with applicable laws and agreements. Please contact an M&T representative for details.