Financing to Meet Your Business Needs

Choosing the right financing options to help you succeed

When it comes to deciding what type of loan is right for your business, you should first consider your needs and options.

How Loans Can Help You Meet Your Business Needs

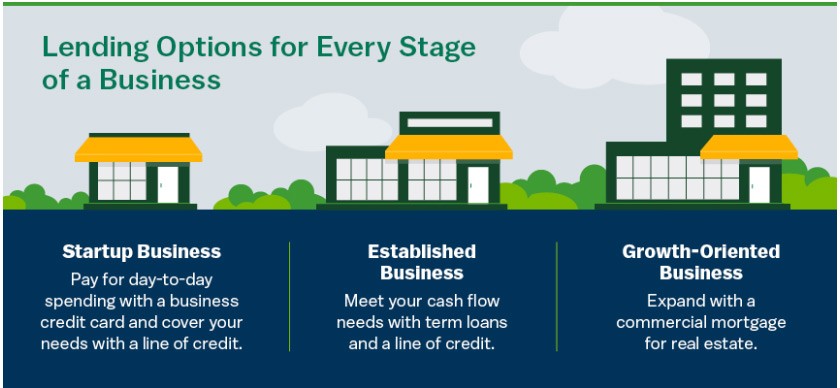

The maturity of your business may influence the lending solution you choose, and the first step to finding the appropriate loan will be to understand your specific needs.

- Do you need capital to grow your business or fund an expansion?

- Do you need working capital to fund an increase in productivity or support higher demand?

- Are you preparing for unexpected expenses?

- Do you want to diversify your business by investing in real estate or acquiring another business?

You know that your business needs to start with operating accounts and the ability to accept and send payments. Then, comes the need for a credit card for daily expenses. But as your business grows, your needs evolve, and you might need loans to hire staff, develop new products or purchase or lease more space. Each need you identify will track to a specific lending solution—or potentially, multiple solutions.

How businesses start with credit

Business credit cards are typically the easiest loans to be approved for, so smaller businesses often start out by opening one to pay their expenses and build their business credit. There’s a need for a business credit card for every business, and there’s a need for a credit card and a line of credit for most businesses.

Business credit cards

A credit card is usually a revolving line of credit with a set limit and is meant to be used for those expenses that you’re going to be paying off at the end of the monthly cycle, such as travel costs and gas.

Line of credit

A line of credit is for your cash flow needs, such as meeting payroll and purchasing inventory. They typically allow for larger purchases than a credit card but are harder to get and depend on your credit scores and other factors.

Startups need cash flow

Take, for example, a financial services firm that has just incorporated: The owner will need to hire staff and pay them before the business is generating returns on investments. Management wouldn’t hire support staff, remodel an office or buy supplies with a credit card, but a line of credit will give them money to draw and pay those bills.

With a line of credit, you can pay the interest only versus paying down the entire principal each period. So you can cover your needs, knowing that the revenues are coming later down the road.

Established and growing businesses need working capital

As your business grows, you’ll find that you need working capital above and beyond your day-to-day cash flow needs. Maybe your cash flow doesn’t align with your needs or there is a disruption to your business plan. Growth mode can look different depending on your business model.

- Are you launching new product lines?

- Do you have any expansion projects coming down the line?

- Do you want to buy equipment and machinery, renovate or expand your location?

- Are you feeling pressure from larger clients to extend terms?

- Are you experiencing supply chain issues?

- Do you have a seasonally dependent company, with fluctuations in cash flow?

- Do your vendors offer discounts for bulk purchases?

Consider a medical supply company that has been in operation for a few years. They have found their clients/customer base and likely have enough cash flow to meet their current needs, but then there is a change—a new client requests ongoing large orders be filled under short deadlines—and access to additional funds becomes necessary.

For expanding needs, term loans can have a lasting, long-term impact. Unlike lines of credit, term loans are not meant to be open forever.

Funds can help diversify a business

Is your business in full-on acquisition mode? If so, you might need loans to fulfill long-term visions and goals.

Term loans can be tailored by your lending institution to help you manage a specific issue you are experiencing or a need you have. If you need capital to buy or merge with a business, you might want to take out a loan based on today’s interest rates with a fixed term.

Likewise, if you want to acquire real estate, a commercial mortgage will help. You may want to buy the building where your business will reside, or you may want to diversify your business model by investing in real estate that other businesses will occupy—either way, a mortgage can be tailored to fit your needs.

How does the SBA guaranty work on loans?

A guaranty from the U.S. Small Business Administration, or SBA, can be put on a line of credit, a term loan or a mortgage. Think of SBA as a credit enhancement. If you’ve been in business for less than two years and your credit scores are growing but are still sub-optimal, the SBA guaranty can help you get the funds you need. The SBA can help if your business is highly leveraged or you lack collateral.

The SBA guaranty also helps a lending institution extend credit to individuals and businesses that otherwise might not qualify because they would be in a high-risk category.

Take, for example, a restaurant that is preparing to open. The fledgling restaurateur might have good credit, but the restaurant industry has a high default rate because there is a high percentage of closure. A bank might say, for example You’re looking for $50,000, but we’re only comfortable giving you $25,000. But, with an SBA guaranty on the other half of the loan, they might give you all $50,000.

The SBA program also allows for longer terms. So maybe you’d only qualify for a five-year conventional loan, but the SBA will extend those terms to seven-to-ten years. Not only that but your interest rates are capped with SBA loans.

Make sure you are making the most of your business lending options

GET FAMILIAR

Raising Capital

Understanding your potential business’ financial needs can help determine the funding sources that best meet those needs. Our resources will help to inform you of your next steps. Learn more about raising capital